Section 179 vehicle calculator

2020 Section 179 Tax Deduction Calculator TM. Our Auto Loan Experts Will Steer You Through the Entire Process.

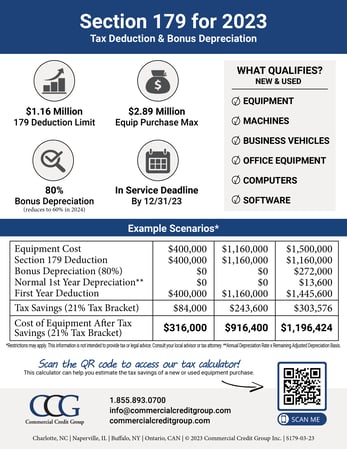

Section 179 Calculator Ccg

Typically light vehicles include passenger vehicles cars small and light crossover SUVs and small pickup trucks and small utility trucks.

. 2019 Section 179 Tax Deduction. Small vehicles that weigh under 6000 pounds have a Section 179 deduction limit of 10100 in the first year they are used and 18100 with bonus depreciation. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

Make your pharmacy more productive profitable when you use this tax benefit with Parata. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. 2022 Ford Transit.

There is also a limit to the total amount of the equipment purchased in one year ie. Due to its passenger-carrying capacity the Transit qualifies for the. Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022.

The benefit of purchasing a heavy vehicle is that the deduction limit for Section 179 is 25000 which is more than double what you can deduct for smaller vehicles. Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased. This free Section 179 calculator is fully updated for 2019 go ahead run some numbers and see how much you can actually save in real dollars this year.

The deduction allowance is. Section 179 calculator for 2022. Section 179 Calculator for 2022.

The Section 179 deduction limit for 2022 has been raised to 1080000. This large passenger van has seating capacity for 15 people and has an MSRP of 41945. Make your pharmacy more productive profitable when you use this tax benefit with Parata.

Our Auto Loan Experts Will Steer You Through the Entire Process. You can get section 179 deduction. Lets say you buy a cargo.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Companies can deduct the full price of qualified equipment purchases up to. Your company is allowed to deduct the full cost of equipment either new or used up to 1080000 from 2022s taxable.

Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense. This free Section 179 calculator is updated for 2020 go ahead and punch up some numbers to see how much you can save. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax.

The total amount that can be written off in Year 2020 can not be more than 1040000. Passenger vehicles exceeding 6000 pounds GVW gross vehicle weight will usually qualify but they are typically limited to a 25000 deduction. Limits of Section 179.

Ad Firstmark Is a Top Auto Loan Provider in San Antonio Get Pre-Approved Online. Ad Firstmark Is a Top Auto Loan Provider in San Antonio Get Pre-Approved Online. Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021.

Section 179 allows a business to write-off the entirety of commercial vehicle and or equipment. Here is the 2018 Section 179 calculator so you can calculate your 2018 Section 179 deduction for equipment vehicles and software. Our section 179 tax deduction calculator can help show you how much money you can save.

Section 179 Deduction Calculator. This article includes a. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax.

Section 179 Deduction For Equipment

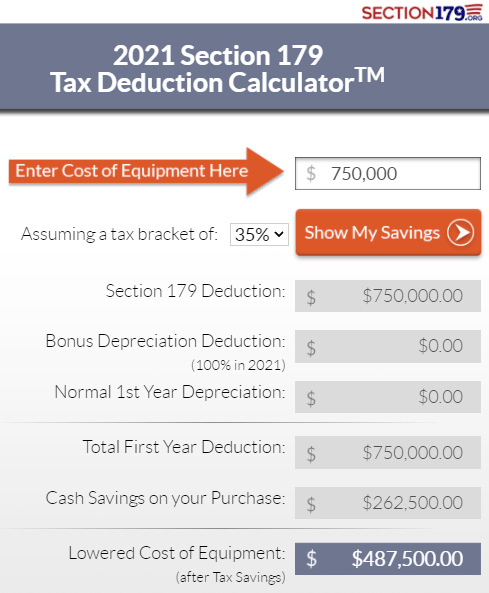

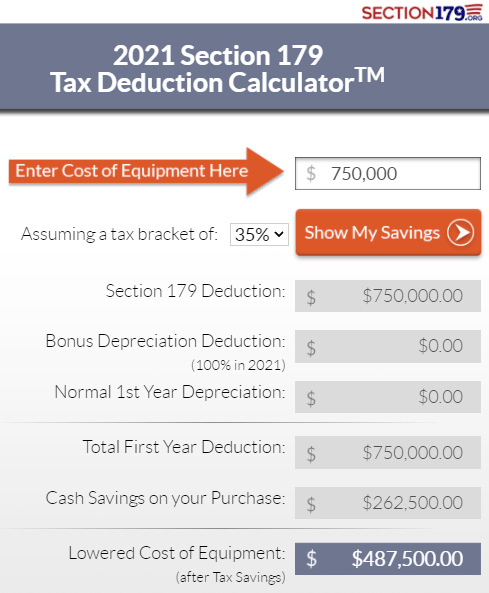

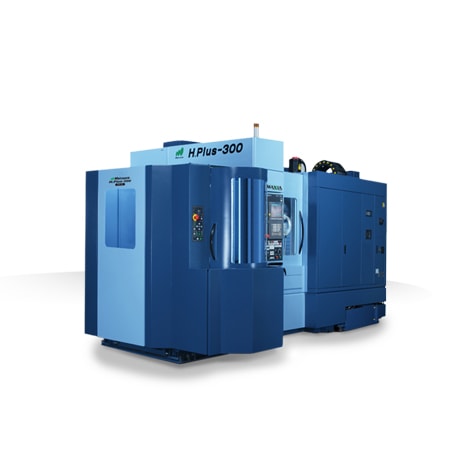

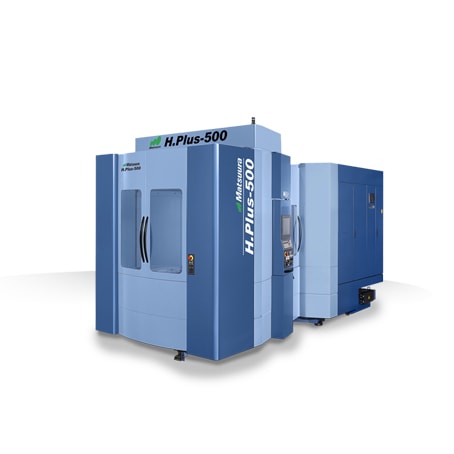

Section 179 Tax Deduction Calculator Matsuura Machinery Usa

Best Vehicle Tax Deduction 2022 It S Not Section 179 Deduction Youtube

Section 179 Tax Deduction Calculator Matsuura Machinery Usa

/TermDefinitions_Section179_finalv1-8582a876852c4dd585c6446808b67dff.png)

Section 179 Definition How It Works And Example

Section 179 Tax Deduction Calculator Matsuura Machinery Usa

The Current State Of The Section 179 Tax Deduction

Section 179 Tax Deduction Calculator Matsuura Machinery Usa

Section 179 Calculator Ccg

Section 179 Deduction Includes Hvac Equipment Purchases Trakref

Pcb Via Current Pcb Trace Width Differential Pair Calculator Pcb Impedance Placa De Circuito Impressa Eletronica Placa De Circuito

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified

Section 179 Tax Deduction Calculator Matsuura Machinery Usa

Section 179 Tax Deduction Official 2019 Calculator Crest Capital

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Tax Deduction Calculator Matsuura Machinery Usa